Making Homeownership Achievable, Together

Prospective homebuyers today might feel like the odds are stacked against them as they face increasing costs, market challenges and other socioeconomic barriers. To help them break through, community banks across the country are stepping up with personalized solutions and initiatives built upon their expertise.

Up-and-Coming Bank Technology: Separating Innovation from Hype

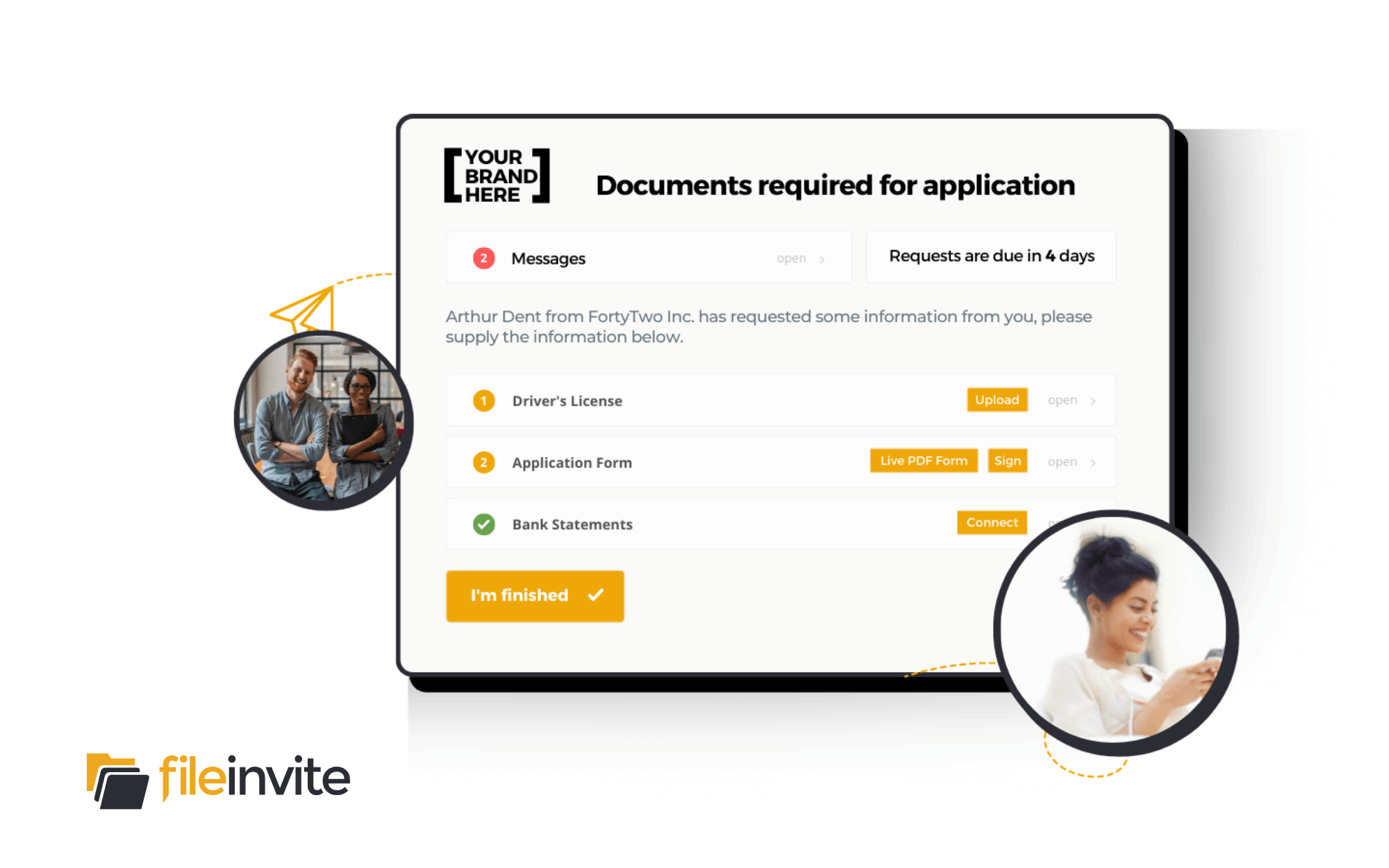

Safeguarding Borrower Data

Understanding the Opportunities and Concerns for Agentic AI

Personalization Strategies, Driven by Community Bank Data

Read the Digital Edition

- Building homeownership dreams

- Spotlight on new banking tech

- Succession planning for family banks

Sponsored Articles

Main Street Matters

Community bank innovation: a multipronged approach to stablecoins, AI, and fraud

Making a list, checking it twice

ICBA advances latest principles for deposit insurance reform to focus policy debate

Be the first to know about the latest issue!

Sign up for Independent Banker eNews to receive twice-monthly emails that alert you when a new issue drops and highlight must-read content you might have missed.

Latest Insights

Payments & Tech

Understanding the Opportunities and Concerns for Agentic AI

Whenever a new technology comes on the market, community banks must gauge whether its potential uses are worthy of the hype and investment. Here’s what you need to know about the newest form of AI, known as agentic AI.